📊 Royalty Sandbox: Simple Profit Share w/ Advance

Here’s how royalties usually breakdown in a record deal

How do royalties actually breakdown in a record deal?

There’s no better place to start than this: the simplest, most common, and – in this royalty accountant’s personal opinion – most likely to succeed record deal, the profit share deal. (“Success” for me is neither party feeling like they got screwed.)

We’ll break it down via three different accounting periods in which “events” take place. A period is the date range covered by a royalty statement, and events are what happened during the period that needs to be accounted.

Update! Here’s a video version of the below breakdown.

A finished, free-to-copy version of this Royalty Sandbox can be found here; a blank template version can be found here. Some of the basic terms and concepts are defined on our Free Royalty Statement Template + Guide page. Ok let’s go!

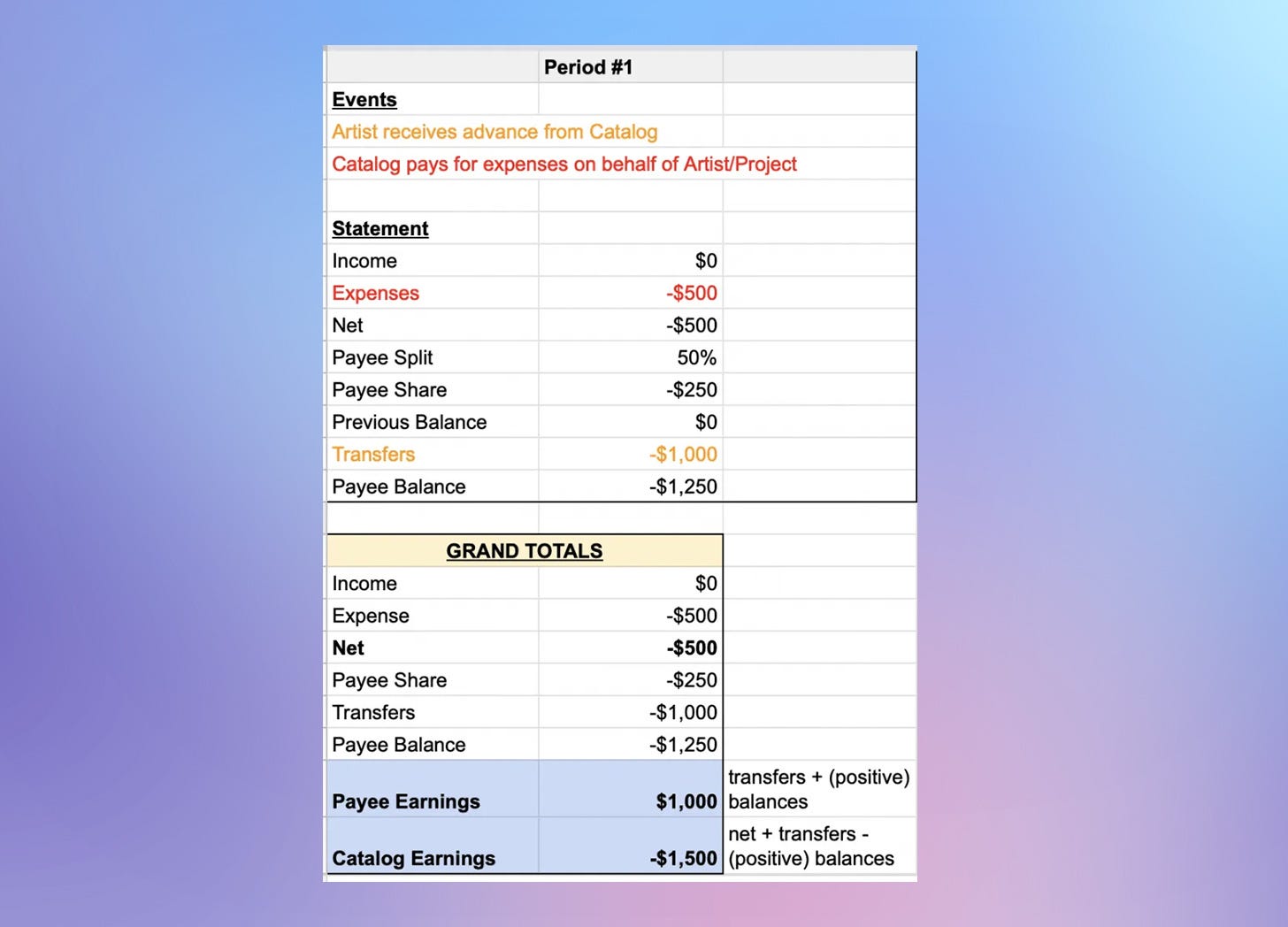

Period #1

Ok, so we’ve got our Events at the top, followed by a simplified profit share “statement”, followed by Grand Totals.

The -$500 worth of expenses, paid for by the catalog, is the only thing in the Net so far, resulting in a -$250 payee share – remember everything in the net, including expenses, gets shared by the participants via the split (often these are called “shared expenses”). There’s also a $1k advance, which gets accounted as a transfer – aka money paid to or from a payee directly. Unlike the net, advances need to be recouped in full by the payee. The payee’s balance, then, is a sum of their share of the net and their total transfers.

The Grand Totals box shows how things stand at the conclusion of the period, across all periods. Right now there’s only been the one period, so the net totals are the same as the statement. The “Earnings” show how much each party has pocketed or spent in total – note this is not quite the same as their balances, due the fact that some money is being split (the net), and some is not (the advance). Right now, the payee has pocketed $1k (the advance they received), while the Catalog has spent -$1500 (the advance and the expenses).

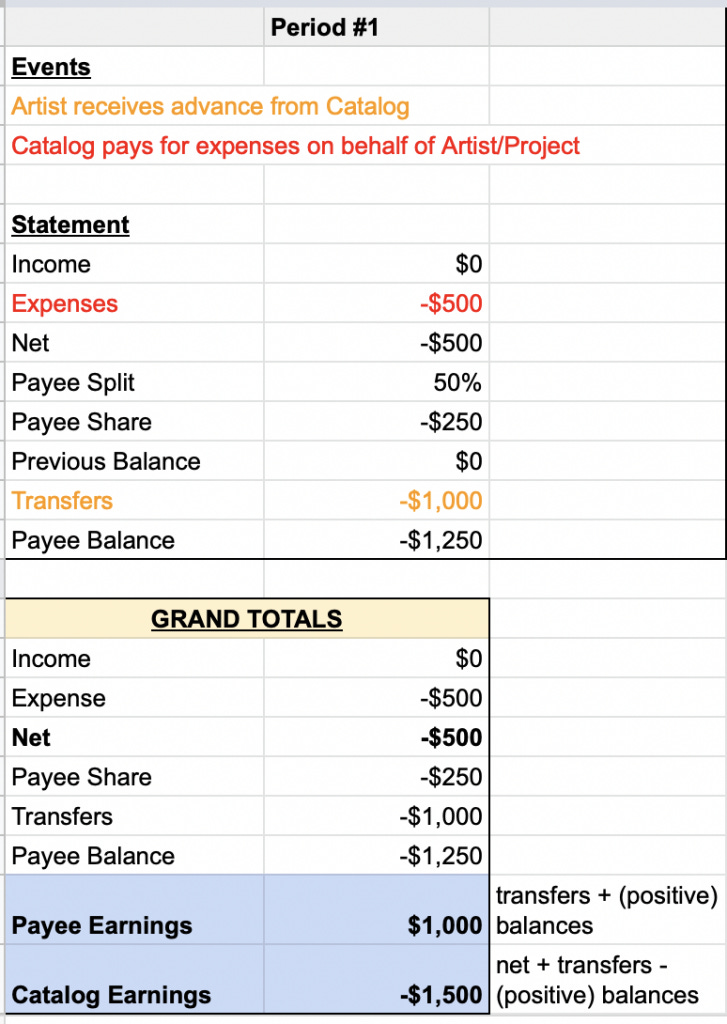

Period #2

Alright, some income! The catalog is doing their job, and money is being generated by the project.

The $3k in income is the only event this period, and the payee share of that is $1500. This amount is greater than their Previous Balance, so the payee has, as we say in the biz “recouped,” with a positive balance of $250.

The grand totals now reflect what’s happened over both periods – the total net is $2500, and lo and behold, the Payee and the Catalog’s earnings are an even split of that net. This is the promise of the 50/50 deal – if everything goes well, you’re equal partners. Note that while the earnings didn’t match up in the first period due to the fact that the net was split while the advance was not, once the advance is recouped (or if there was no advance), the earnings are indeed a simple split of the net.

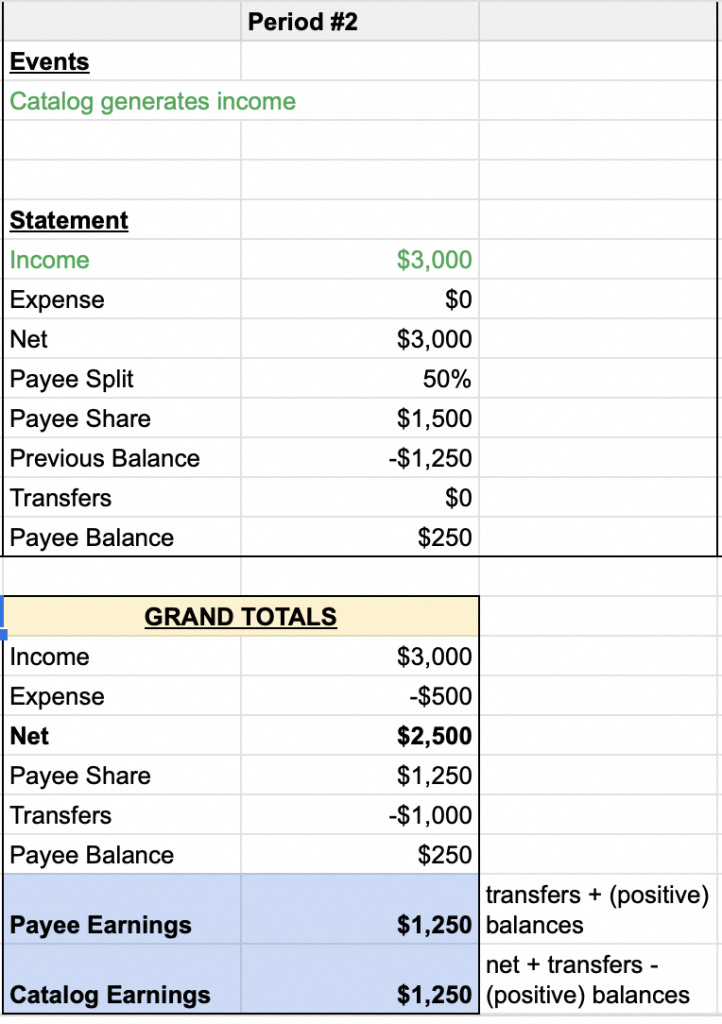

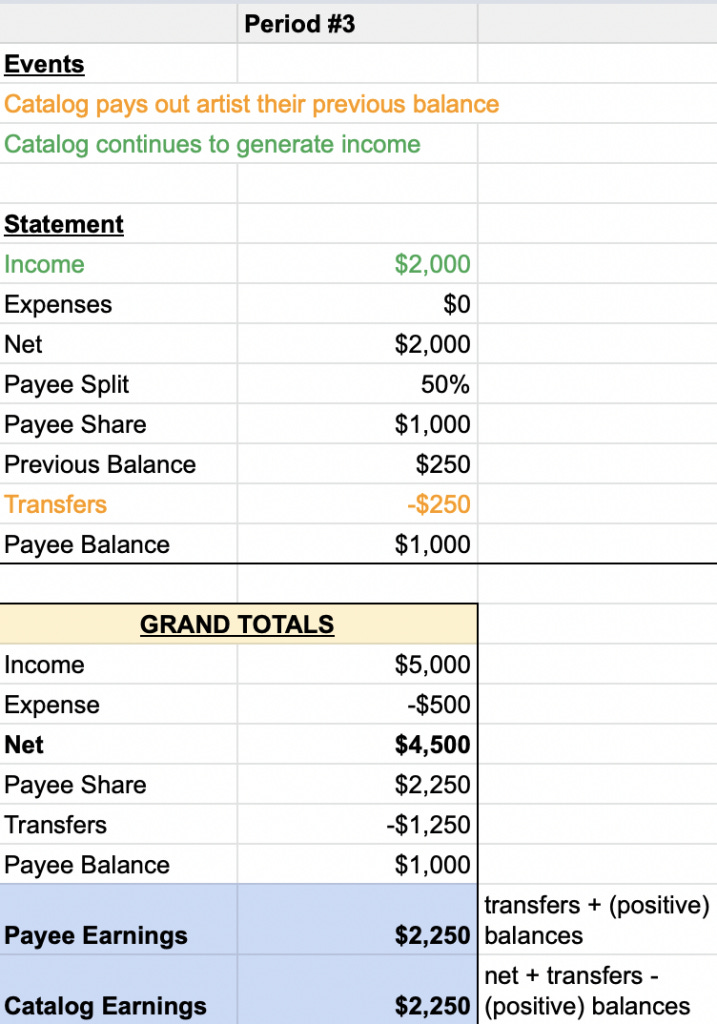

Period #3

The final period of our example starts with a payout to settle the payee’s positive balance from the previous period. Since the payout is being paid directly to the artist and is not part of the net, it gets entered as a transfer (same as the advance).

The grand total of transfers is now -$1250 (the $1k advance and the $250 payout). Meanwhile the catalog is continuing to accrue income on behalf of the artist/project, so the payee balance and total earnings keep on increasing 🙂

Ok that’s it! Once again, you can view/copy the Sandbox for this particular breakdown here, or grab a blank template here.